We can take a shortcut and just divide this figure by the number of billable hours, but that doesn’t indicate how much you actually make. So, first, let’s pull out the current tax brackets 2023 table for those living in the US.

To determine how much is 60,000 a year is worth an hour, I’m going to make a few assumptions:

- You live in the US

- You a single tax filer

- Your income source comes from a state with no State Income Tax (Florida, Nevada, Texas, Washington, Wyoming, Alaska, Tennessee, and South Dakota)

- There are no other deductions from your Income besides the Federal Tax.

Remember that, based on how your file your tax, these figures are going to differ. For instance, you could be married filing jointly, separately, or filing your tax as head of household. In these cases, your computations are going to be different than the ones we have below.

$60,000 a Year is How Much an Hour

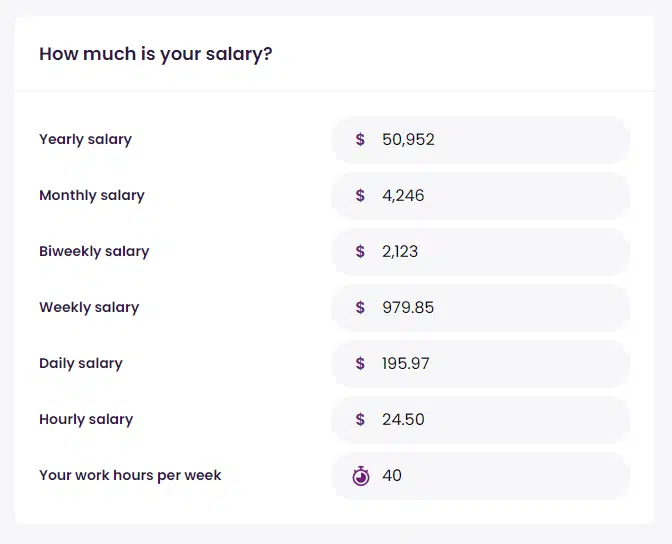

If you make $60,000 a year, your Federal tax translates to $9,048, bringing down your taxable income to $50,952 and thus an hourly rate of $24.49, assuming that you work 40 hours a week for the 52 weeks.

Read on to see how we arrived at this hourly rate.

2022 Federal Income Tax Brackets Table (Single Filer)

| Tax rate | Taxable income bracket | Tax owed |

|---|---|---|

| 10% | $0 to $9,950 | 10% of taxable income |

| 12% | $9,951 to $40,525 | $995 plus 12% of the amount over $9,950 |

| 22% | $40,526 to $86,375 | $4,664 plus 22% of the amount over $40,525 |

| 24% | $86,376 to $164,925 | $14,751 plus 24% of the amount over $86,375 |

| 32% | $164,926 to $209,425 | $33,603 plus 32% of the amount over $164,925 |

| 35% | $209,426 to $523,600 | $47,843 plus 35% of the amount over $209,425 |

| 37% | $523,601 or more | $157,804.25 plus 37% of the amount over $523,600 |

How Much Tax Do You Pay on a $60,000 Salary?

Using the table above, your taxes will be computed as follows:

Taxable income breakdown:

- $9950

- (40, 525-9950)= $30,575

- (60,000-40,525)= $19,475

| Taxable Income | Tax Owed |

|---|---|

| 1. $9,950 x 0.10 | $ 995 |

| 2. $ 30,575 x 0.12 | $ 3669 |

| 3. $18,475 x 0.22 | $4,384 |

| Total Tax>> | $9,048 |

| Income after Federal tax | $50,952 |

Thus, your net Income should come down to $50,952

How Much is Your Salary— Breakdown

| Yearly Salary | $60,000 |

| Yearly Salary after Federal Tax | $50,952 |

| Monthly Salary | $4,246 |

| Bi-weekly Salary | $2123 |

| Weekly Salary | $979.85 |

| Daily Salary | $195.97 |

| Hourly Salary | $24.50 |

Converting $60,000 a Year In Another Time Unit

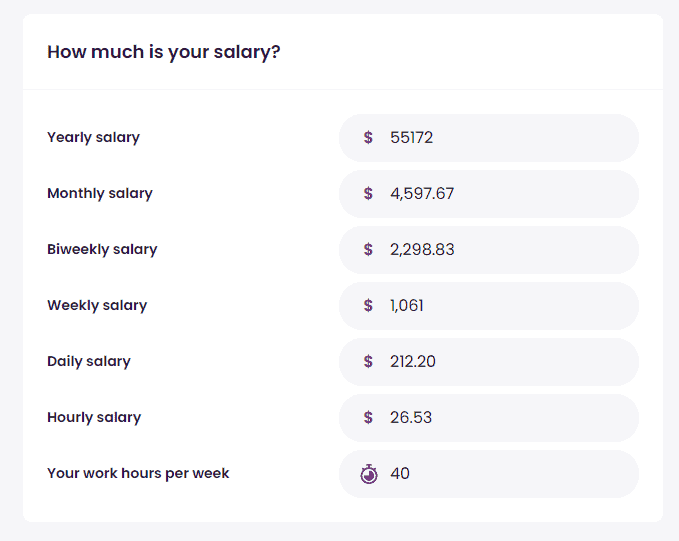

Also, $65000 a Year is How Much an Hour?

If you make $65,000 a year, your Federal Tax comes to about $9829, bringing your total income after federal taxes to $55,171

Thus, $65,000 a year is $26.53 as indicated below: