Being a freelancer allows you time, freedom, and flexibility that you otherwise would not have with a traditional full-time job.

However, you also lose some perks, such as a retirement account tied to an employer. This means your finances and investments become your sole responsibility.

Investments make so much possible, including planning for emergencies and retirement. They also allow you to reach life milestones like purchasing a home. Here’s how you should approach investing to get the best outcome as a freelancer.

Separate your personal and business finances

A critical part of investing is having the money to do so, which typically comes from your savings. Having separate business and personal accounts will help you avoid being confused about which funds belong where.

You will also have a clearer picture of how much you make and, therefore, how much you can save.

Understand investments

Investing is buying assets whose value you think will increase in the future. These assets are your investments, and they can range from stocks and bonds to mutual and exchange-traded funds, real estate, and foreign currencies.

Investments are usually divided into high-, medium-, and low-risk investments. The level of return is dependent on the level of risk; higher risk often leads to higher returns. Although the high returns of high-risk investments are tempting, it is best to start with low-risk investments like dividend stocks, high-yield savings accounts, and treasury bills.

It is also a good idea to consider alternative investments like options trading. Options trading can provide high returns in a short period, but it requires a thorough understanding of different strategies and techniques and carries moderate risk.

Whether you are starting or have been trading for a while, the advice and resources provided by an experienced options trader will be invaluable in helping you reach profitability, minimize risk, and achieve your investment and financial goals.

Create investment goals

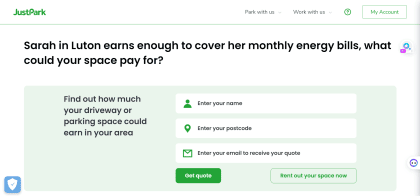

Goals are crucial for helping you map out your life, career, or growth. They are also a critical part of investing. Start by asking yourself what you want to achieve with your investments. Perhaps you want to buy a new home, invest more, or retire comfortably. Whatever you want will dictate how you structure your goals.

You should also state both your short and long-term goals. You can then commit the required amounts to each to achieve them.

Diversify and rebalance

After choosing a few initial investments, start conducting additional research to see which other options you can add to your portfolio. For example, you might find out real estate is doing well in your areas and include this.

Rebalancing means finding which investment options are not performing as expected and either reducing their weight or eliminating them. It also entails which ones weigh disproportionately more. Since they are performing well, you can reduce them and increase the percentage of other investments.

Doing so helps you maintain a healthy balance between risk and profitability, both crucial to freelancers investing in their futures or retirement.

Invest income increases first

You are already used to the lifestyle your current income allows you. Understanding this, you will be able to invest your income increases and bonuses for the first three to six months without feeling a difference in your lifestyle. Many freelancers tend to splurge when they receive such increases or bonuses, forgetting they do not have the safety nets and options available to those formally employed.

Over time, you can adjust your investment plan to include the rate. For example, you can choose to invest 20% of your income plus any bonuses you receive. Increasing the invested amount like this means you reach your financial goals faster.

Invest in annuities

Annuities are insurance products and a contract between both of you. Depending on the arrangement, you can make regular payments or a lump sum payment, and the insurance company pays you in the future. These companies can do this because they invest your money in different areas to ensure a return.

The main benefit of an annuity is that you can receive monthly payments for a specified period, or the rest of your life. Additionally, your beneficiary receives a payment if you pass away before you start receiving it.

Lastly, annuities are tax deferred. You do not pay taxes on the investment gains or income until you withdraw the money.

Savings and investments are crucial for freelancers because of the nature of their work and income. Fortunately, there are numerous investment opportunities for you; you only need the right approach and plan.