Bank of America is a U.S.-based bank that has been in business since 1904. It provides consumer and commercial banking services, as well as wealth management, investment banking, and sales and trading services.

It is a Fortune 500 company headquartered in Charlotte, North Carolina, with branches scattered throughout the United States.

Bank of America is the second-largest bank in the United States. The company has over 4,700 branches, 16,000 ATMs, and employs over 200,000 people. They have a market capitalization of around $300 billion.

International Money Transfers with Wise

Is this your first time sending money internationally?

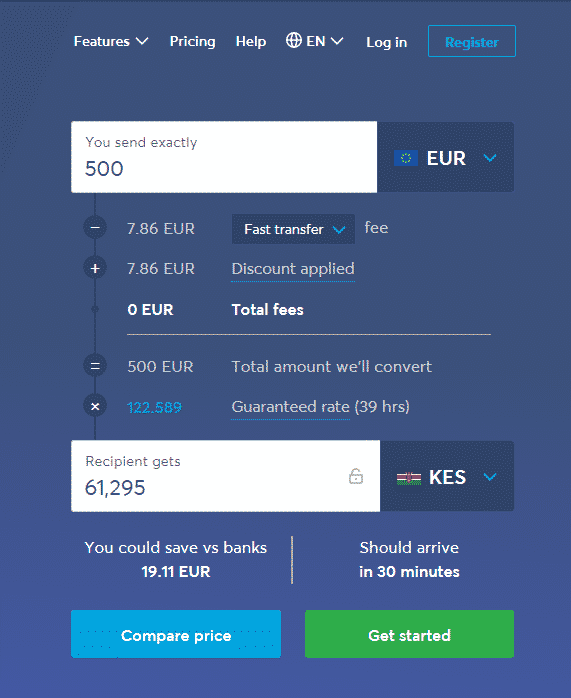

Sending money abroad can be stressful, especially if you don’t know what you’re doing. That’s why we recommend using a service such as Wise (formerly, Transferwise) which offers some of the most competitive rates on the market. Their process is also super easy, making it possible for anyone to send and receive money across countries.

Here are just a few reasons to try Wise:

- Most competitive rates

- Easy process

- Secure transfers

- Wise is trusted by giant companies like

Bank of America Routing Number for Wire Transfer

Need to make a wire transfer? In that case, the location-based routing numbers in the table in the next section won’t work. You need a different code for domestic and international transfers.

The domestic wire transfer code for the Bank of America is 26009593. For international wire transfers, you will need a SWIFT code instead. SWIFT code is also referred to as BIC code. The Bank of America’s swift code for international wire transfers is BOFAUS3N.

When transferring in another currency, you can use BOFAUS6S instead.

Bank of America Routing Numbers by State

| Branch Location | Bank of America Routing Number |

| Alabama | 051000017 |

| Alaska | 051000017 |

| Arizona | 122101706 |

| Arkansas | 082000073 |

| California | 121000358 |

| Colorado | 123103716 |

| Connecticut | 011900254 |

| Delaware | 031202084 |

| Florida, East | 063100277 |

| Florida, West | 063100277 |

| Georgia | 061000052 |

| Hawaii | 051000017 |

| Idaho | 123103716 |

| Illinois, South | 081904808 |

| Illinois, North | 071000505 |

| Illinois, Chicago Metro | 081904808 |

| Indiana | 071214579 |

| Iowa | 073000176 |

| Kansas | 101100045 |

| Kentucky | 051000017 |

| Louisiana | 051000017 |

| Maine | 011200365 |

| Maryland | 052001633 |

| Massachusetts | 011000138 |

| Michigan | 072000805 |

| Minnesota | 071214579 |

| Mississippi | 051000017 |

| Missouri East/St. Louis | 081000032 |

| Missouri West/Kansas City | 081000032 |

| Montana | 051000017 |

| Nebraska | 051000017 |

| Nevada | 122400724 |

| New Hampshire | 011400495 |

| New Jersey | 021200339 |

| New Mexico | 107000327 |

| New York | 021000322 |

| North Carolina | 053000196 |

| North Dakota | 051000017 |

| Ohio | 071214579 |

| Oklahoma | 103000017 |

| Oregon | 323070380 |

| Pennsylvania | 031202084 |

| Rhode Island | 011500010 |

| South Carolina | 053904483 |

| South Dakota | 051000017 |

| Tennessee | 064000020 |

| Texas, North | 111000025 |

| Texas, South | 113000023 |

| Texas, South | 111000025 |

| Utah | 123103716 |

| Vermont | 051000017 |

| Virginia | 051000017 |

| Washington | 125000024 |

| Washington, D.C. | 054001204 |

| West Virginia | 051000017 |

| Wisconsin | 051000017 |

| Wyoming | 051000017 |

What is a Routing Number?

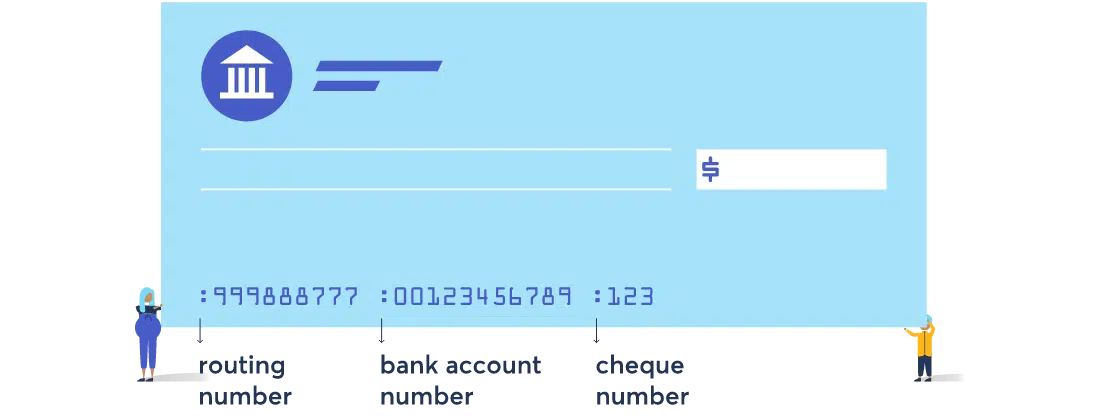

A routing number is a nine-digit code that identifies your bank and other financial institutions in the US. It’s used to process all payments in the U.S., and it helps ensure that your money gets to where it’s supposed to go.

It’s also called an ABA routing number, and it’s used to identify and process transactions between financial institutions.

Routing numbers are used by the Federal Reserve Banks to process Fedwire funds transfers and Automated Clearing House (ACH) for processing electronic fund transfers.

Routing numbers differ for checking and savings accounts and wire transfers.

While banks may have a few different routing numbers, they are unique to that bank, meaning routing numbers are never shared with another bank. This helps ensure that funds don’t end up in a wrong bank.

What are routing numbers used for?

Routing numbers are used for processing various financial transactions. You might need a routing number to:

- Receive payments in your account

- Set up a direct deposit or automatic bill payment from your Bank of America balance

- Make a wire transfer or ACH payment

How to Find Your Bank of America Routing Number

To find your routing number, look at the bottom of your checks or deposit slips. The first 9 digits on the left side are your routing number.

Other Bank Routing Numbers

Here are some other banks whose routing numbers we’ve covered before:

- Well’s Fargo Routing Numbers

- Chase Bank Routing Numbers

- American Express Routing Number

- PNC Bank Routing Numbers

- TD Bank Routing Numbers

Cheaper Way to Send and Receive International Payments

Wise makes sending and receiving money across countries seamless, faster, cheaper, and convenient. Use our link to send $500 without sending fees.

Here are just a few reasons to try Wise:

- Most competitive rates

- Easy process

- Secure transfers

- Wise is trusted by giant companies

Make borderless transactions easy